By Anish Mandal, Partner, Energy Resource and Industrial (ER&I) Solutions at Deloitte

Over the last two decades, India’s energy sector has undergone a remarkable change. In FY10 India’s annual energy deficit was ~10% against a demand of ~830 BU1, which came down to ~0.1%1 by FY25 when the demand reached ~1694 BU1. The country has not only bridged deficits but also emerged as one of the fastest-growing renewable energy markets in the world. By 2030 to keep up with the growing power demand, India plans to achieve 500 GW non-fossil fuel capacity. The country also has ambitions to reach net-zero emissions by 20702. As of 31st July 2025, the country’s installed renewable energy capacity remains at ~238 GW .

This rapid rise of solar, wind, and hybrid systems has changed the fundamental nature of the grid. Multiple policies and schemes play a key role to push innovation and upgrade the electricity infrastructure as they push the network towards decentralization. Green Energy Open Access Rules (2022) allows consumers above 100 kW load to procure renewables, necessitating advanced metering, protection, and inverter-driven integration. Revamped Distribution Sector Scheme (RDSS) enables investments in smart meters, digital substations, and SCADA systems (SCADA: Supervisor Control and Data Acquisition). PLI (Production Linked Incentive) schemes ensure incentives for solar modules, batteries, and semiconductors aiming to localize supply chains. The PM Surya Ghar Muft Bijli Yojana pushes mass rooftop solar installations with subsidies to households up to ₹78,000 (INR: Indian Rupee) for 3 kW systems.

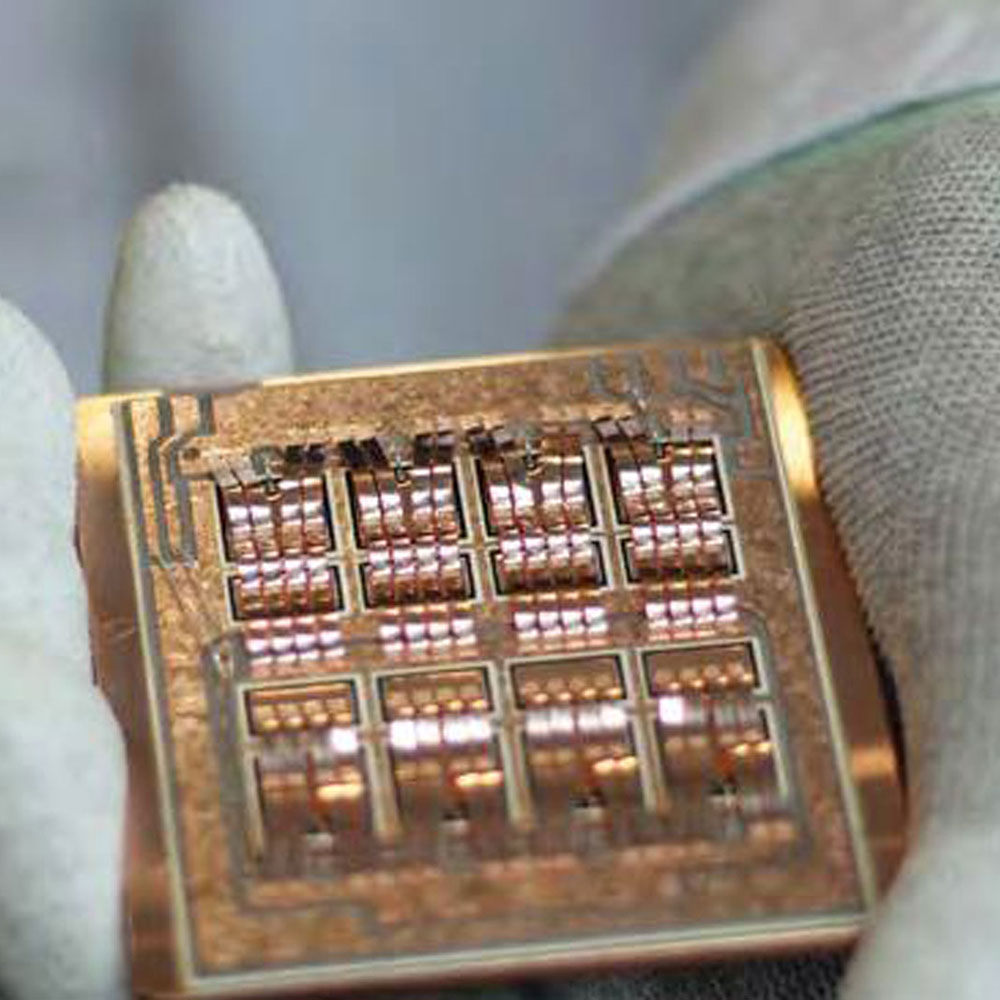

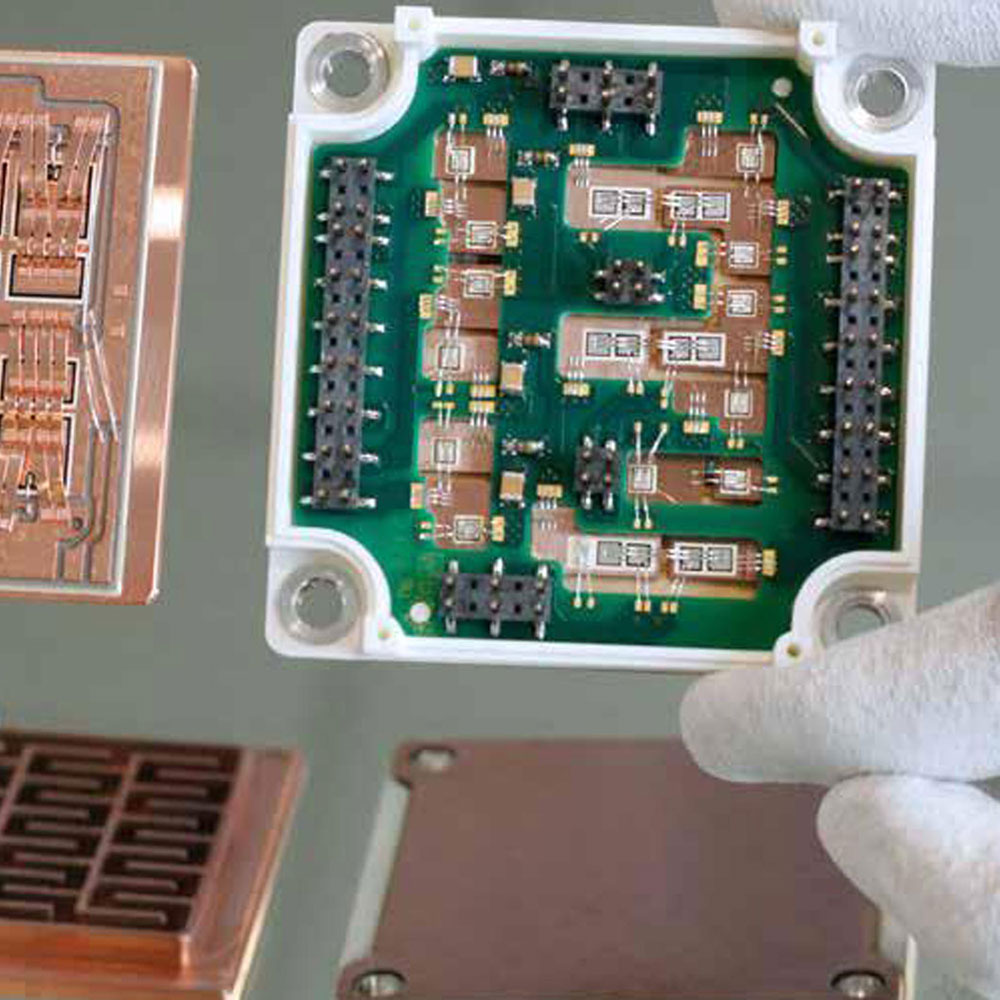

These trends in the sector induce variability, two-way flows from distributed generation, and new demand segments such as data centres, electric mobility, and green hydrogen are redefining power system planning. They also expose three major stress points. Firstly, renewable generation peaks misalign with the demand peaks, requiring interventions life agricultural demand shifts and deployment of energy storage solutions. Secondly, renewable rich states like Rajasthan, Gujarat, Karnataka face evacuation challenges if transmission corridors are not timely expanded. Thirdly, rooftop solar, EV (Electric Vehicle) charging, and prosumer models push networks toward higher automation and bidirectional flows leading to distribution complexity. Traditional electromechanical systems cannot address these challenges and power electronics enter the fray. Power electronics is the application of semiconductor electronics to the control and conversion of electric power and uses devices like inverters, converters, FACTS (Flexible Alternating Current Transmission System) etc. They smooth out fluctuations, eliminate harmonics, and prevent blackouts.

In essence, power electronics are at the heart of reshaping the Indian electricity grid. To rely on renewable energy India needs to focus on robust interstate transmission system. Certain states in the country are resource rich but to carry the power to the load centres India is developing the transmission backbone. HVDC (High Voltage Direct current – enabled by semiconductor switches) acts as a major component of transmission system to move bulk renewable power over long distances with minimal losses. Moreover, FACTS devices like STATCOMs (Static Synchronous Compensator) and SVCs (Static Var Compensator) stabilize voltage and improve power quality in renewable-rich states. For instance, STATCOM installations in Rajasthan have become critical for solar evacuation. Inverters are critical in converting DC power to AC and managing frequency and voltage when transmitting renewable energy. Also, power electronics enables full integration of solar, wind, and battery energy storage, creating firm and dispatchable renewable power.

Currently, India’s interstate backbone has rapidly expanded at 765 kV AC and multi-terminal HVDC, with dynamic voltage support (STATCOMs) at key nodes to steady weak grids with high RE (Renewable Energy). The country is building multi-GW HVDC links out of mega-parks such as Khavda (Gujarat) to central/western load centres. Prior to FY12, India’s HVDC expansion was largely focused on 500 kV projects. Post FY12, however, the focus shifted toward higher-capacity 800 kV and lower capacity 320 kV HVDC systems as well8. Between 2007 and 2022, renewable energy additions in India have shown a positive correlation with HVDC transmission capacity growth. On average, every 1 MVA of HVDC capacity added has been accompanied by about 1.77 MW of renewable energy additions.

From a distribution perspective, inverters integration with rooftop solar ensures power conversion, voltage support and remote monitoring. Fast charging electric vehicles employ DC Fast Chargers plays a crucial role, hence making power electronics a non-negotiable part of the Indian net zero ambition. In Bengaluru, BESCOM (Bangalore Electricity Supply Company Limited) has deployed automated reclosers and sectionalizers with power electronics, cutting fault restoration times significantly.

The use cases of power electronics are well identified however, from a supply chain perspective, China leads in HVDC and semiconductor manufacturing. Europe mainly focuses on grid forming inverters. United States strongly pushes on SiC and GaN devices, supported by DOE (Department of Energy) funding for domestic fabs. For India, without strengthening its domestic power semiconductor ecosystem, dependence on imports can become a long-term vulnerability, especially as demand for EVs, BESS (Battery Energy Storage System), and inverters uprises. In December 2021, Indian government announced USD10 billion incentives for semiconductor and display fabs. Moreover, the country allocated approximately USD 360 million for semiconductor and display fabs in the budget for 2023–2024 and about USD 830 million in the interim budget for 2024–2025.

In the hindsight, as artificial intelligence is growing it calls for significant number of data centres – enhancing the requirement of power electronics. Moreover, AI/ML integration with electronic controllers are key enablers for predictive maintenance, grid-adaptive inverter responses, larger demand response programs, and DER (Distributed Energy Resources) aggregation which can enhance customer experience, support effective peak management, and reduce downtime for distribution companies.

The coming decade will decide whether India can build a truly resilient and sustainable grid. Power electronics and semiconductors will be at the heart of this journey, enabling higher renewable penetration, enhancing power quality, and accelerating industrial decarbonization. Power electronics is the silent backbone of India’s energy transition – unseen but indispensable. Just as microchips ignited the digital revolution, power semiconductors and electronic systems will determine the pace and success of India’s green revolution. For policymakers, industry leaders, and technology developers alike, the imperative is clear: invest, innovate, and integrate power electronics at every layer of the electricity value chain. st