PCIM Magazine: The power semiconductor industry has been one of the beneficiaries of the major transformation efforts of recent years in terms of energy transition, eMobility, and Green Deal. Would you say that this assessment has changed massively since the re-election of Donald Trump as US President?

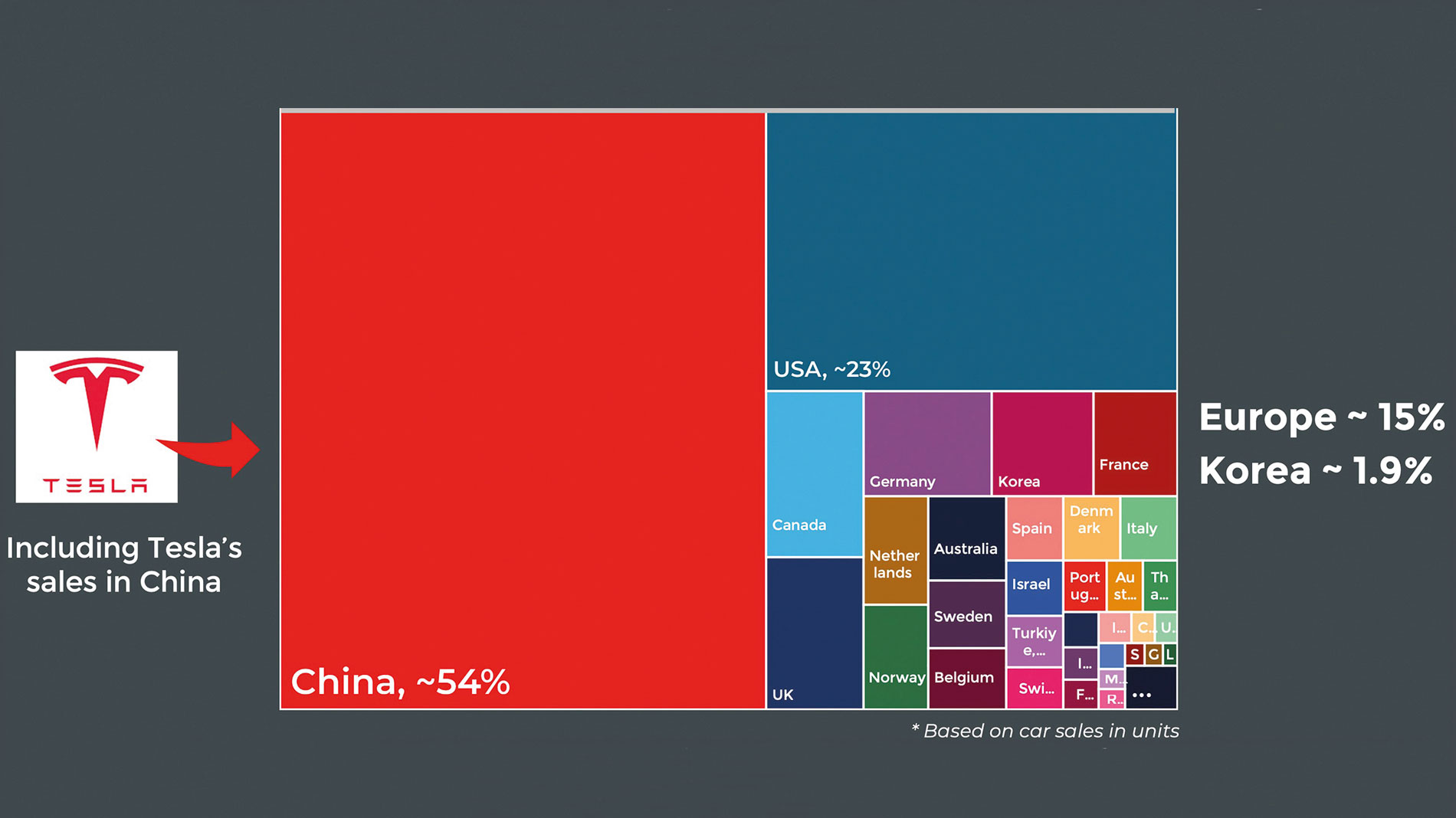

Poshun Chiu: In SiC and GaN, we might not see major changes in the direction of development. China is the biggest country for eMobility, with more than 50 percent if we only consider SiC. It’s more for international device manufacturers, such as STM, to find customers in China. And others plan to have partnerships or at least packaging capability in China. But, some impacts on managing sourcing can be expected, as international device players need to keep non-Chinese SiC wafer suppliers. So the effect is more at the material level.

Jean-Christophe Eloy: EV is a complex subject for the US administration. On the Chinese side, it is different: As the Chinese EV market constitutes now more than 50 percent of the global EV market, as mentioned by Poshun, Chinese administration and industries will do all they can to be independent of US SiC wafers, devices, and module manufacturers. The STM/Sanan Optoelectronic agreement is moving in that direction.

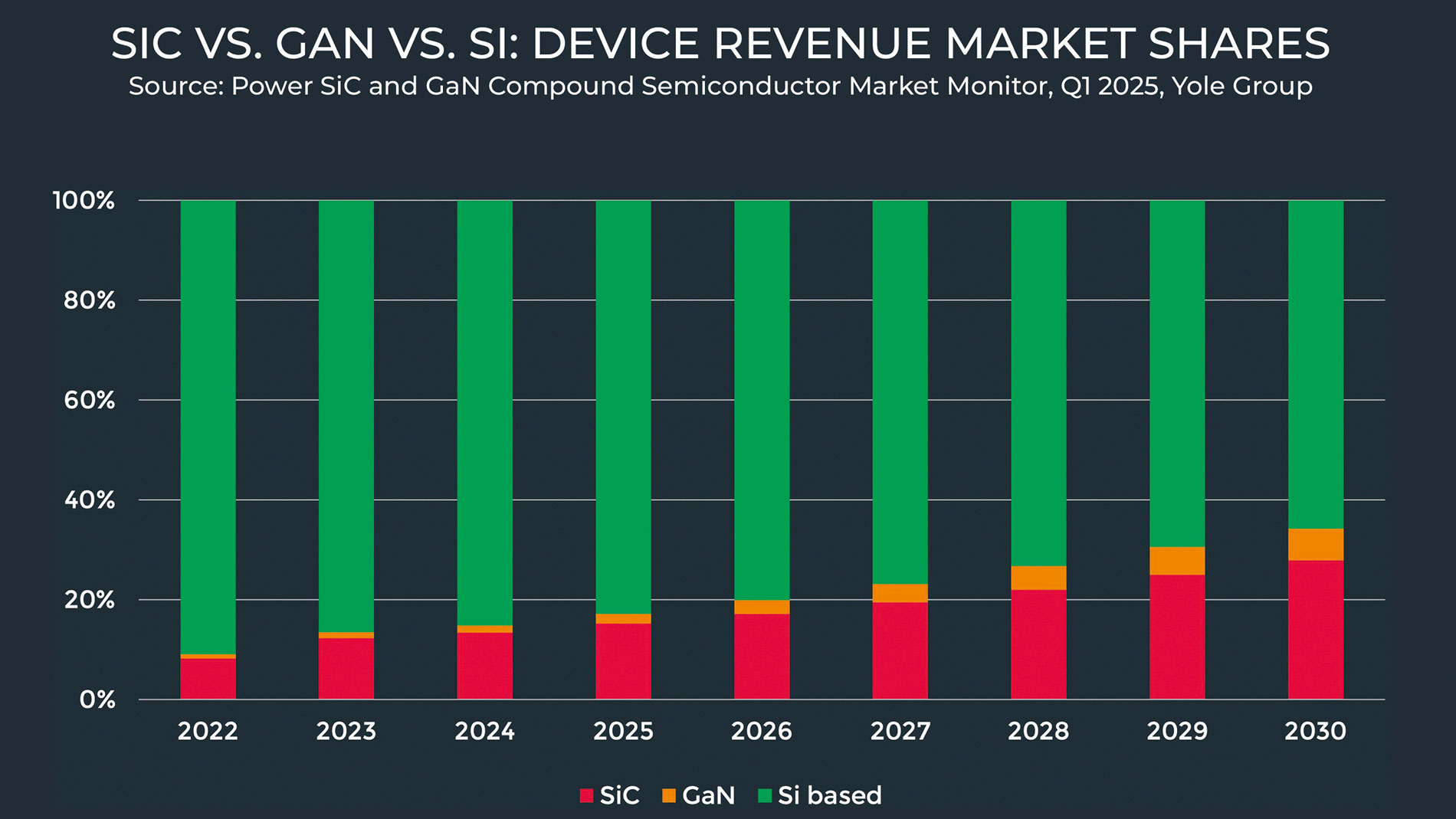

Wide-bandgap power semiconductors such as SiC and GaN are expected to approach a 40 percent share of the power semiconductor market by 2030.

The changes are most noticeable in the SiC market. An absolutely overheated market has built up capacity for which it is now becoming difficult to find customers to the extent forecast. How would you describe the current SiC market?

Poshun Chiu: The short-term, 2025-26, will have a much lower growth rate, down from 40 percent to 12 percent, compared to the 2024/2023 and 2025/2024 values. The slowdown is mainly due to the automotive market. As the capacity expansion of players was set with an expected trajectory of 40 percent market growth, most players are adjusting the pace of expansion.

Jean-Christophe Eloy: But if you are looking at subsequent trends, after 2026, all the key trends in EVs like higher voltage battery, short or ultra-short charging time, longer range for EVs are supported by the integration of SiC devices and modules. As there is more competition at the Sic wafer and SiC devices levels, the price is going down, opening other applications and market opportunities. So even if the coming years will show lower growth, in the middle term, more will happen.

Three years ago, your market research institute, Yole, forecast that SiC would account for 30 percent of the power semiconductor market in 2028. Do you still stand by this forecast, or is this a figure that is more likely to be reached only in the early 2030s?

Poshun Chiu: According to the latest forecast, SiC’s growth momentum is expected to recover in the mid- to long-term, reaching nearly 30 percent by 2030. Together with GaN, WBG devices will go beyond 30 percent by 2030.

Jean-Christophe Eloy: The key structural added value of semiconductor manufacturing is starting to be implemented on SiC devices: the more production capacity you have, the more price pressure there is, the more applications will be targeted by SiC devices because of the price decrease. It will enable the long-term growth of the SiC wafer and device market.

In the past, SiC has primarily replaced IGBTs in existing applications. With the cooling of the SiC market, are your market researchers registering a recovery or even a renaissance of the IGBT market?

Poshun Chiu: The two will co-exist in the market, even for automotive. One thing is that SiC shows very strong pricing down due to over-capacity and production scaling. However, IGBT keeps improving its cost-competitiveness as the platform moves toward 300 mm. In power electronics globally, both technologies are evolving, and innovative hybrid solutions with SiC and IGBT in the same module could create a stronger synergy between the two technologies.

Jean-Christophe Eloy: The companies that are gaining the full benefit of the parallel evolutions of IGBT and SiC MOSFET are the companies producing both devices, which is the case of Infineon. Looking at the 2024 data, Infineon is able to grow both markets.

The SiC market has long welcomed companies that were latecomers in this area, most recently Renesas. Do you think there will be more late entrants, or do you expect a wave of consolidation in the SiC market in the near future?

Poshun Chiu: Some consolidation is happening, for example, Onsemi acquired Qorvo’s JFET business. Major IDMs will keep the majority of the market value. However, as we said in the beginning, Chinese players are advancing, and we expect to see more Chinese players entering and gaining more market share in the next few years.

Jean-Christophe Eloy: Yes, more consolidation will happen, certainly among Chinese and non-Chinese companies. Cross-border cooperation is happening, but mainly in JVs.

In addition to the sharp drop in numbers in the e-car sector, it is likely to be the up to 30 percent lower prices for SiC wafers from China that is putting pressure on the well-known western SiC specialists. A disadvantage for vertically integrated companies?

Poshun Chiu: It depends on whether the discussion is about devices or wafers. Chinese wafer players have about 40 percent of the market share in 2024, much higher than two years ago. And the trends are continuing as discussed earlier. At the device level, EV remains the major market driver, and total shipments will keep growing, thanks to the push in China. Value is captured by device manufacturers, and they are building strategies to have deeper engagements in China. Therefore, IDMs will remain the leaders in the coming years.

Jean-Christophe Eloy: Another area to look at in-depth is the module manufacturers: their added value is clear, and the number of companies mastering good-performance SiC power modules is limited.

China has already shown what is possible in the SiC wafer sector. When do you expect something similar to happen in the area of SiC MOSFETs? Before the end of this decade?

Poshun Chiu: Chinese players such as UNT and Sanan gained nearly 10 percent of the SiC device market in 2024, according to our investigation. They are established players with more to come.

And this will grow to the range of 15 to 20 percent in the next few years, as the OEMs are asking for local sourcing for a more secure supply.

Jean-Christophe Eloy: The Chinese semiconductor content in Chinese cars is increasing year after year. So yes, at some point, high-end MOSFETs and IGBTs for automotive and industrial applications will be produced in China; it is only a matter of time.

The topic of scaling. Various manufacturers around the world are working on the transition from 6-inch to 8-inch SiC wafers. This is already a reality at Wolfspeed and Infineon. Will the next ones follow this year or in 2026 in order to remain competitive, at least in terms of the unit price of SiC MOSFETs? Who do you expect next?

Poshun Chiu: All the major players have announced their plans to move to 200 mm. Wolfspeed was the first, and Infineon just released its products. However, the EV slowdown doesn’t help. It will take a bit longer than expected. Despite the actual ramp-up taking longer, qualifications and pilot lines are pulling the 200 mm wafer shipments.

Jean-Christophe Eloy: The transition will happen when needed and it seems to have been delayed at the moment. However, it can restart as soon as the market needs the 8-inch production manufacturing structure. Also allowing time for the wafer manufacturers and device makers to get the right performances and yield.

In less than 10 years, between 40 and 70 billion dollars have been invested or announced in expanding SiC capacities worldwide. This boom was largely due to political support for the transition in the energy and mobility sectors. Have you experienced something similar in your career as a market researcher? What lessons can be learned from this?

Poshun Chiu: PV and LED are good examples to mention.

Jean-Christophe Eloy: We see it at the moment in the investments of memory makers for HBM, as well as at foundries, including TSMC, for advanced packaging production capacity expansion. So yes, such high-level market expansion has already happened in the past and is currently underway in fields other than SiC.

Let’s move on to GaN. Can we assume that the difficulties with SiC will lead to GaN securing a significant share in the automotive sector, for example, more quickly than previously expected? Do you generally expect the cool-down in the SiC sector to fuel the GaN business?

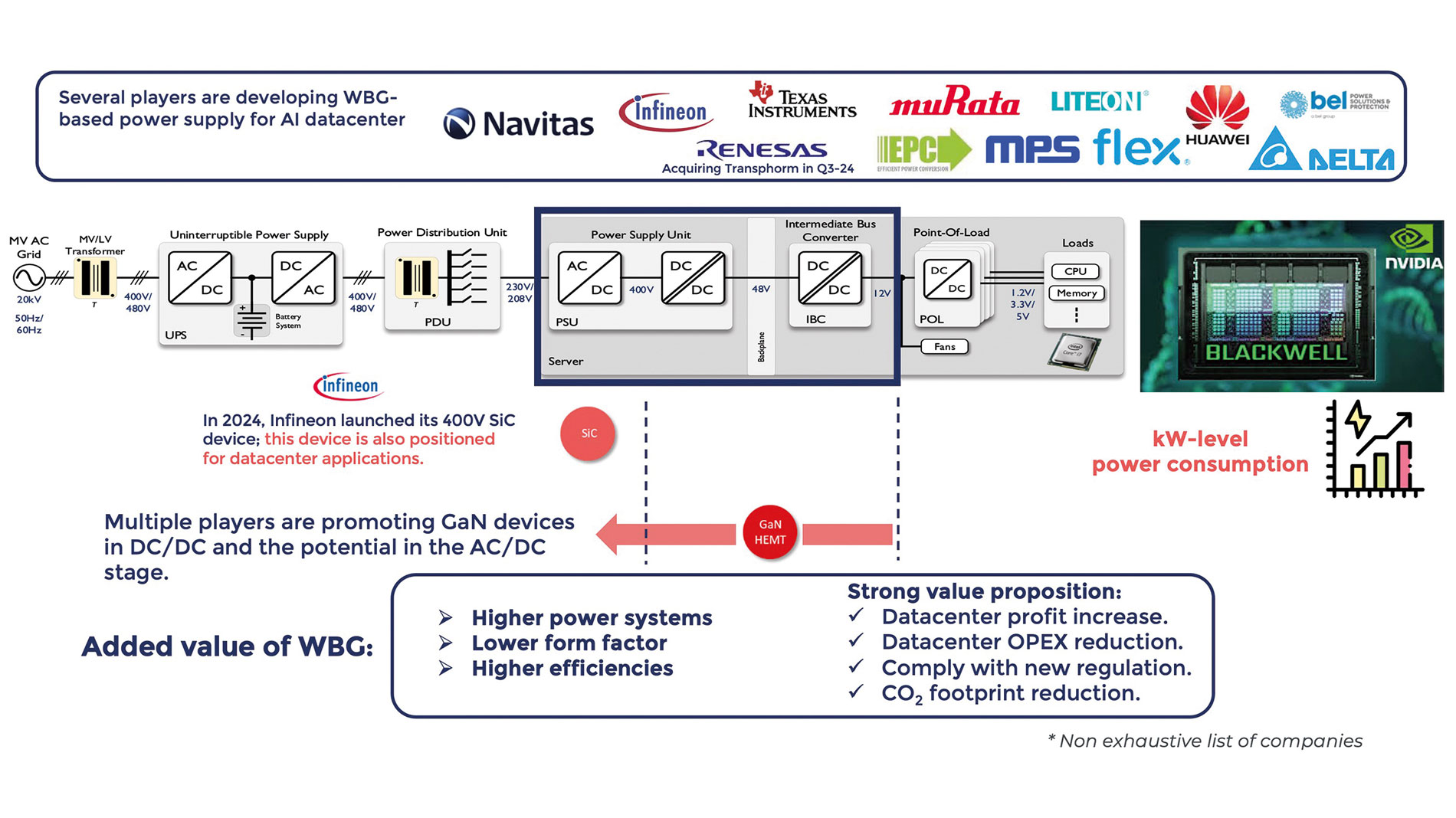

Poshun Chiu: The leading companies are indeed looking for new opportunities from the end-market, and, from a technology perspective, GaN is the one to be promoted now. GaN has good opportunities to grow with AI data centers, the power supply for PSUs, even on the low-voltage side. At the same time, we have started seeing OBC designs with GaN technology. Therefore, GaN’s momentum is not really relevant to the move away from a SiC focus. Instead, the technology shows added value in some specific end-markets.

Jean-Christophe Eloy: GaN and SiC power devices have limited competition so far, as they target many different applications. So both types of devices will grow in parallel, with limited overlap.

Onsemi bought the former NexGen Power Systems fab at the end of last year. Could it be that vertical GaN, unlike expectations a year and a half ago, could be ready for the market before 2030 at voltages of 1200V and above?

Poshun Chiu: At the moment, we haven’t seen the inflection point for vertical GaN, but R&D in advance is always needed. 1200V-GaN could be either realized by multi-level topology or by increasing the breakdown voltage of lateral GaN, but the cost would be an issue for another day.

One final question: Trump is pushing his vision of the global economy. How much do you think the issue of protective tariffs will affect the power semiconductor industry in the future? Or do you consider that power semiconductors are not the strategic focus of the new US administration?

Jean-Christophe Eloy: So far, we have not seen any push by the US administration to apply specific regulations on SiC and Gan devices. We do not have a clear understanding of what will happen in the next weeks, months, and quarters.

The interview was conducted by Engelbert Hopf.

SiC and GaN will be of decisive importance for the power supply of AI data centres in the near future.